modified business tax id nevada

This number 9 digits long and unique to your company will serve as a unique identifier at the federal level not unlike. TID Taxpayer ID Search.

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Nevada modified business tax form 2022ablets are in fact a ready business alternative to desktop and laptop computers.

. If you need help with the Nevada Modified Business Tax Form or the Nevada Modified Business Return AMS Payroll 134 is the best product to try. 5 Federal Tax Identification Number 6 CorporateEntity Address. How do I change my modified business tax return in Nevada.

Messy andor incomplete data is the. Nevada Tax Center. The Tax IDentification number TID is the permit number issued by the Department.

This bill mandates all business entities to file a Commerce Tax return. The easiest way to manage your business tax filings with the Nevada Department of Taxation. Now working with a Nevada Modified Business Tax Form 2020 requires no more than 5 minutes.

The majority of Nevada businesses will need to get a federal tax ID number. A Nevada Employer is defined as per NRS 363B030. You must provide a valid Nevada Account Number and Modified Business Tax MBT Account Number to sign up for Square Payroll.

If you have quetions about the online permit application process you can. Email the amended return along with any additional documentation to email protected OR mail your amended. Street Number Direction N S E W and Name Suite Unit or Apt City State and Zip Code 4 State of Incorporation or.

Log In or Sign Up to get started with managing your business. Get Your Nevada Tax ID Online. Search by Permit Number TID Search by Address.

In the New Nevada Employer Welcome package sent by NV after a company. Total gross wages are the total amount of. To avoid duplicate registrations of businesses you are required to update your account with your Nevada.

These numbers are required for us to make state tax. You can easily acquire your Nevada Tax ID online using the NevadaTax website. Any employer who is required to pay a contribution to the Department of.

Search by Business Name. 99-9 9 digits Find a current MBT Account Number. You can take them everywhere and even use them while on the go as.

Modified Business Tax is a self-reporting tax and you are responsible for properly characterizing your business as a Financial Institution or General Business. The New Business Checklist can provide you a quick summary of which licenses youll need estimated cost and time to obtain licensing. Our state-specific online samples and complete recommendations eliminate.

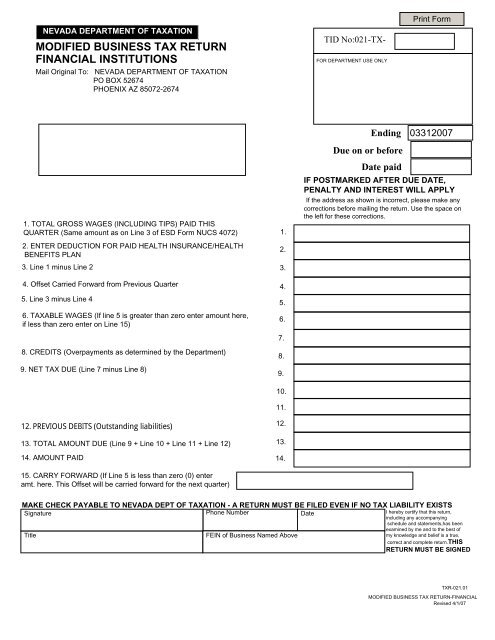

The modified business tax covers total gross wages less employee health care benefits paid by the employer. However the Department will classify taxpayers when it discovers through account review audit a lead or other research that a company falls into one of the definitions under NRS 363A050. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as.

NV DETR Modified Business Tax Account Number. Search by Business Name. Searching the TID will list the specific taxpayer being researched with its affiliated locations.

What is the Modified Business Tax. Modified Business Tax NRS 463370 Gaming License.

Modified Business Tax Return Financial Institutions

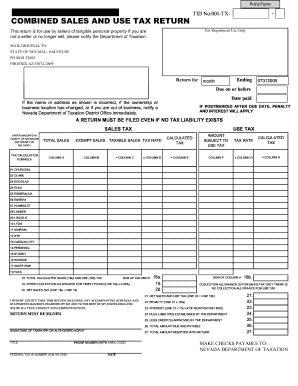

Nevada Sales And Use Tax Close Out Form Download Fillable Pdf Templateroller

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Nevada Commerce Tax What You Need To Know Sage International Inc

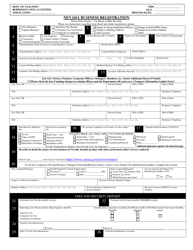

Nevada Nevada Business Registration Form Download Fillable Pdf Templateroller

Nevada Consumer Use Tax Fill Out And Sign Printable Pdf Template Signnow

Modified Business Tax Return Financial Institutions

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Blayne Osborn Blayneosborn Twitter